- Bank account (e-Mandate + Physical mandate)

- UPI autopay

- Standing Instructions (SI) on cards (credit or debit) (Indian and International)

| Payment methods supported | Banks or card networks or UPI handles | Maximum subscription amount allowed |

|---|---|---|

| eNACH | Check the list of NPCI-supported banks here | ₹ 1,00,00,000 |

| UPI autopay | Check the list of banks and PSPs here | ₹ 15,000 (without AFA) or ₹ 1,00,000 (with AFA) |

| Card (Indian) | Visa, Mastercard, RuPay | ₹ 15,000 (without AFA) or ₹ 1,00,00,000 (with AFA) |

| Card (International) | Visa, Mastercard | ₹ 1,00,00,000 |

| Physical mandates | Check the list of banks here | ₹ 1,00,00,000 |

For UPI autopay: UPI PIN

For Standing Instructions (SI) on cards: OTP or other 2FA as per issuing bank

According to NACH guidelines, e-NACH is permitted only for individual accounts. This applies to both savings and current accounts with a single registered signatory.

Corporate current accounts with multiple registered signatories must use physical NACH.

There is no authorisation amount charged for e-NACH. The charge is zero (0).

| Payment methods | Supported frequencies |

|---|---|

| eNACH | Day, Week, Month, Year, and ad-hoc. |

| UPI autopay | Day, Week, Month, Year, and ad-hoc. |

| Card (Indian and International) | Day, Week, Month, Year, and ad-hoc. |

| Physical NACH | Day, Week, Month, Year, and ad-hoc. |

Bank account (e-Mandate)

Customers can authorise the subscriptions using their bank account via net banking, debit card or Aadhaar. They must enter their bank account details and authorise the subscription. The payment gets debited automatically based on the plan selected.To authorise using a bank account

On the checkout page, customers must:- Select Bank Account (e-Mandate) as the payment method.

- Select their bank and the preferred authorisation mode: Net Banking, debit card, or Aadhaar (depending on availability for the bank).

- Enter the required details, and approve the subscription.

Bank account (Physical mandate)

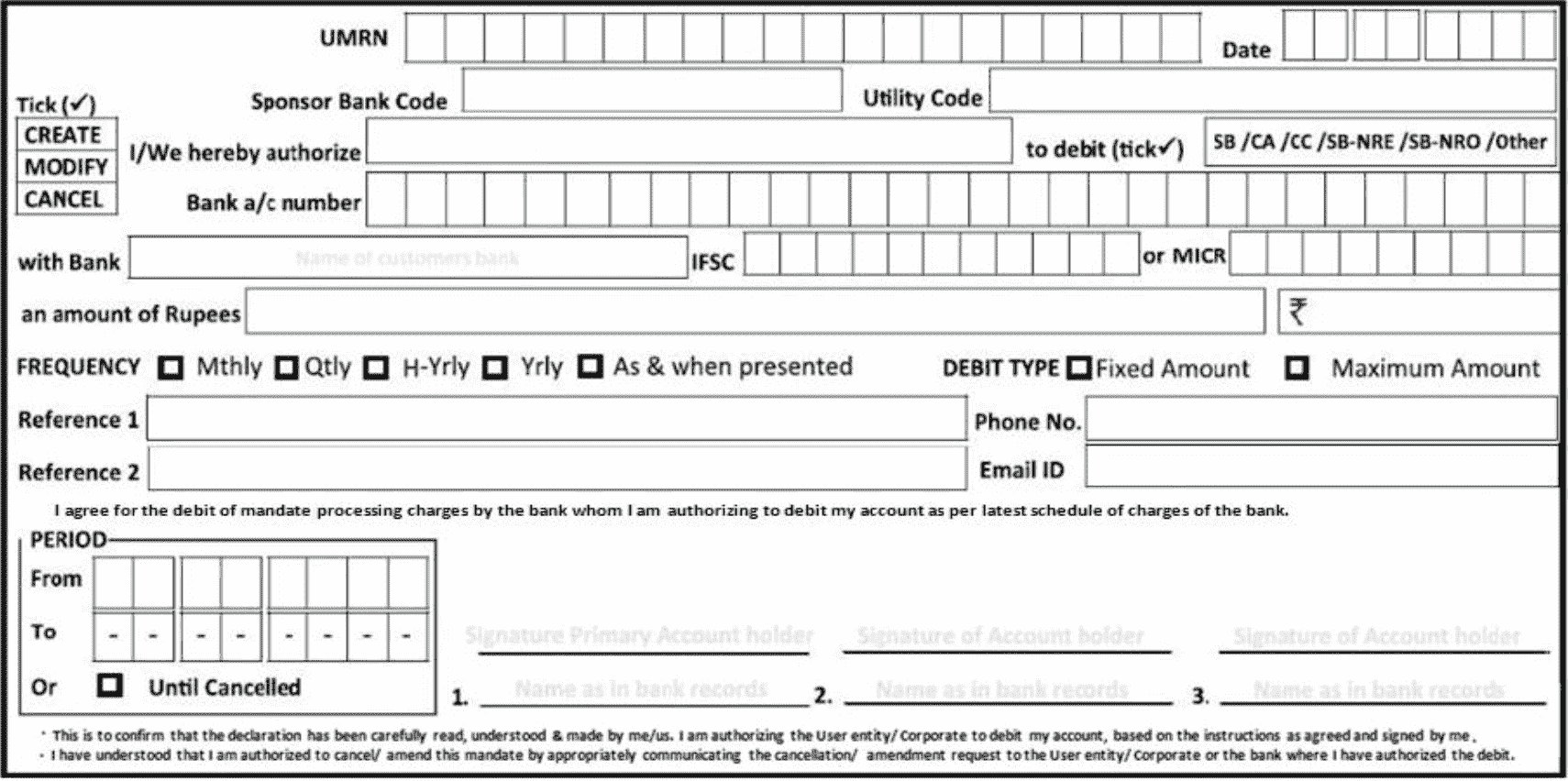

Customers can authorise the subscriptions using only their signature and bank account details. There is no requirement to have a debit card or net banking enabled to set up the mandate. The physical NACH form includes several fields that can be pre-filled to simplify the process. Leave the UMRN (Unique Mandate Reference Number) field blank when creating a mandate. Cashfree will provide values for the Sponsor Bank Code, Utility Code, and Authoriser Information. Refer to the sample physical mandate below.

- Date: The date when the form is filled.

- Frequency: Select an appropriate option based on your use case: Monthly, Quarterly, Half-yearly, Yearly, or As and when presented.

- Amount: The mandate amount to be debited.

- Debit type: Select Fixed Amount for recurring payments or Maximum Amount for on-demand debits.

- Reference 1 and Reference 2 (optional): Use these fields to add internal remarks, subscription IDs, or other identifiers relevant to your system.

- Period of mandate: Enter the mandate duration, from the first debit date to the subscription end date. To keep the mandate active until cancelled, select Until Cancelled.

- Use the Bulk Physical Mandate feature on the Cashfree dashboard to upload the details, or

- Integrate using the following Cashfree APIs:

- Step 1: Create subscription: Use this API to create a subscription for your customer that includes providing customer and mandate details. If the mandate details such as amount and frequency are the same for all your customers you can create a plan before creating a subscription. The response will give you the list of supported banks applicable for physical mandate.

- Step 2: Upload file: Use the Upload File API to upload the physical Nach registration forms that contain your customer’s bank account details, mandate details and signature. You will receive a file ID in the response, this needs to be used in the next step.

- Step 3: Create auth seamless physical mandate: Use the Create Auth Seamless Physical Mandate API to create an authorisation request for your customer. For physical mandates, this API informs Cashfree Payments that the NACH form should be submitted to the bank for mandate registration in production.

Banks supported

You can find the list of supported banks here.

You can find the list of supported banks here.

Debit or credit card (Issued in India)

Customers can authorise the subscriptions using their debit or credit card. They must enter their card details to authorise the subscription similar to a regular one-time online payment. The payment is automatically debited based on the plan selected. All issuing banks are supported for credit and debit card payments.Debit or credit card (Issued outside India)

Customers can authorise the subscriptions using their debit or credit card. They must enter their card details to authorise the subscription similar to a regular one-time online payment. The payment is automatically debited based on the plan selected. All issuing banks are supported for credit and debit card payments and 140+ currencies are supported.UPI autopay

Payments for subscriptions via UPI give customers the flexibility to pay using any UPI application. Customers must first enter their UPI VPA and authorise the subscription. For mandates where debit amount is greater than Rs. 15,000, customers will need to enter their UPI PIN on the collect request triggered to their VPA. No such customer input is required for debit amount less than Rs. 15,000.- As per NPCI guidelines, starting August 1, 2025, UPI autopay transactions will be processed only during non-peak hours: before 10:00 AM, between 1:00 PM and 5:00 PM, or after 9:30 PM. For more information, refer to the new guidelines.

- As per recent RBI guidelines, for mutual fund payments, credit card payments, and insurance premium payments, no customer input is required for debit amounts up to ₹1,00,000.

The table below lists the intent applications supported by subscriptions:

| Apps | Android Intent | iOS Intent |

|---|---|---|

| Paytm | ✔️ | ✔️ |

| GPay | ✔️ | ✔️ |

| PhonePe | ✔️ | ✔️ |

| AmazonPay | ✔️ | ✔️ |

UPI autopay is supported for all methods via Intent Flow, Collect Flow, and QR Flow.